Credit scores play a major role in financial life. They influence loan approvals, interest rates, insurance decisions, and even rental applications. When a credit score seems unfair or unexpectedly low, many people wonder: can we dispute our own official credit scores?

The answer is both yes and no. You generally cannot dispute the score number itself, but you can dispute the information used to calculate it. Understanding this distinction is essential for improving credit accurately and legally.

What Is an “Official” Credit Score?

An official credit score is a numerical summary of your creditworthiness generated by a scoring model.

Common Credit Scoring Models

- FICO® Score

- VantageScore®

These models calculate scores using information from your credit reports, not personal opinions or manual judgment.

Why You Cannot Dispute the Score Itself

A credit score is not an opinion—it is a mathematical result.

How Scores Are Created

Credit scores are generated automatically based on:

- Payment history

- Credit utilization

- Length of credit history

- Credit mix

- New credit inquiries

Because the formula is applied consistently, the score itself is not considered disputable.

What You Can Dispute Instead

While the score cannot be disputed directly, the data behind it can be.

Disputable Credit Report Errors

- Accounts that do not belong to you

- Incorrect balances or credit limits

- Wrong payment statuses

- Duplicate or outdated accounts

- Incorrect personal information

Correcting errors can lead to a score increase naturally.

How Credit Report Disputes Work

Disputes are handled by credit bureaus, not scoring companies.

The Dispute Process

- Identify inaccurate information

- File a dispute with the credit bureau

- The bureau contacts the data provider

- The provider verifies or corrects the information

This process usually takes up to 30 days.

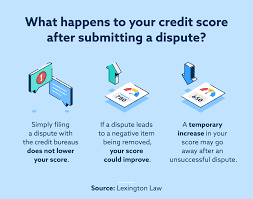

Does Disputing Information Automatically Raise Your Score?

Not always.

Possible Outcomes

- Score increases if negative errors are removed

- No change if disputed data is verified as accurate

- Temporary fluctuations during updates

Results depend entirely on the accuracy of the information.

Common Misconceptions About Credit Score Disputes

“I Can Dispute a Score I Don’t Like”

A score you dislike but is accurately calculated cannot be disputed.

“Disputing Everything Will Raise My Score”

Frivolous or inaccurate disputes may be ignored and can slow progress.

“Credit Bureaus Change Scores Manually”

Credit bureaus store data; scoring models calculate scores automatically.

When It Makes Sense to Dispute Credit Information

Disputes are most effective when:

- You spot clear factual errors

- Identity theft is involved

- Accounts are reported incorrectly after being paid

Disputing valid information simply because it is negative rarely helps.

How Often Can You Dispute Credit Report Errors?

You can dispute errors whenever they appear.

Best Practices

- Dispute only legitimate inaccuracies

- Provide supporting documentation

- Track dispute results

Accuracy and patience matter.

What If My Score Is Low but My Report Is Accurate?

If the data is correct, improvement requires behavior change—not disputes.

Ways to Improve Credit Without Disputes

- Pay bills on time

- Reduce outstanding balances

- Limit new credit applications

- Build positive payment history

Time and consistency drive real improvement.

Who Regulates Credit Reporting and Disputes?

Credit reporting is governed by consumer protection laws in many countries.

Consumer Rights

Consumers generally have the right to:

- Access their credit reports

- Dispute inaccurate information

- Receive corrected reports

Understanding these rights empowers smarter financial decisions.

Are Credit Repair Companies Necessary for Disputes?

Not usually.

DIY vs. Paid Services

Everything a credit repair company does, you can do yourself—often for free. The difference is convenience, not effectiveness.

How Long Until Corrected Information Affects My Score?

Once corrected information is updated:

- Scores may change within days

- Full updates may take a billing cycle

Patience is important.

Final Thoughts

So, can we dispute our own official credit scores? Not directly. Credit scores themselves cannot be disputed because they are mathematically calculated. However, you absolutely can—and should—dispute inaccurate information on your credit reports.

Improving credit is not about arguing with a number. It is about ensuring the data behind that number is fair, accurate, and complete. When your credit report tells the correct story, your credit score will reflect it.

The most effective credit repair strategy is simple: correct what is wrong, manage what is right, and give the process time.

Word Count:

599

Summary:

Many of us wonder even if it is this legal to do so. Well, YES, you are given the right under the Fair Credit Reporting Act (FCRA), including the right to challenge inaccurate, misleading and obsolete items appearing on your credit report. Disputing items on your credit report is your legal right (see the Fair Credit Reporting Act)! This article is meant to provide important information about the possibility of having credit restoration.

Keywords:

credit repair,Arizona,credit help,Phoenix,clean credit,credit restoration,Maricopa credit,credit repair in Phoenix,credit help Arizona,best credit

Article Body:

Many of us wonder even if it is this legal to do so. Well, YES, you are given the right under the Fair Credit Reporting Act (FCRA), including the right to challenge inaccurate, misleading and obsolete items appearing on your credit report. Disputing items on your credit report is your legal right (see the Fair Credit Reporting Act)! This article is meant to provide important information about the possibility of having credit restoration.

For starters, you should know on what is your credit score based. Credit scoring is based on many factors that may include:

� Amount of available credit

� Payment history

� Recent requests for credit

� Amount of credit currently being used

� Length of credit history

Under the Equal Credit Opportunity Act, credit scoring may not use gender, marital status, national origin, race, or religion as factors.

So, getting to the point: can bad credit be deleted? Well� YES! Negative credit listings are deleted from peoples’ credit reports each and every day! Still, you might need to get some professional support and assistance. Companies specialized in credit repair in Phoenix will use very venue available to you under the law, to help you assert these rights. When you hire professionals to help repair your credit, they will be abiding by and using all federal and regional laws regulating third party credit repair assistance.

Arizona credit help firms are working hard every day, challenging damaging and questionable credit entries on behalf of its clients. Utilizing proven and absolutely legal methods, you will have a professional organization working for you and your credit.

There are many of you who will say �OK, but how long does it take? Of course, everyone wants you to see results immediately. Most people can see progress within the first 45 days of credit repair services, although everyone’s credit history is different. Don�t ignore the fact that the majority of time is spent waiting for the credit bureaus to respond to requests. It takes great effort in getting the disputes to the bureaus as fast as possible. As a reference, the average person with 7-10 inaccurate, misleading or obsolete items on each credit report should be prepared for a 3-4 month commitment.

Maricopa Credit organizations have been helping people get rid of negative items on their credit reports, increasing their FICO score dramatically. With a higher FICO score, their clients have been able to refinance their auto and home loans, saving a considerable amount of money every single month!

Just keep in mind that you�d still have to pay your bills. When a negative credit report listing is deleted, the actual debt remains. You still owe the same amount of money that you owed to begin with. If you don’t pay the debt, the creditor or collection agency could always report the item again. So removing the listing without addressing the debt is only a temporary solution.

For even more information and real help, you should find a firm helping hard working men and women repair their credit reports. Such credit help companies help thousands of Americans repair their reports by removing inaccurate, misleading, or unverifiable items for them. From bankruptcies to charge offs, their staff have challenged and deleted such items with ease. After your own research, choose the best firm, the one with no hidden fees, offering unlimited disputes and not charging per deleted item. Whether you have one or one hundred negatives items, you must be backed by a Money Back Guarantee policy.

Leave a Reply