A bad credit score can feel like a financial dead end. Loan applications get rejected, interest rates rise, and even everyday opportunities can become more expensive. It is common to wonder whether professional help is required—or if it is possible to fix bad credit alone.

The honest answer is: yes, you can fix your bad credit on your own, but it takes time, discipline, and realistic expectations. This article explains what repairing credit by yourself involves, what works, what does not, and how to stay on track.

Understanding What “Bad Credit” Really Means

Before fixing credit, it is important to understand what caused the problem.

Common Causes of Bad Credit

- Late or missed payments

- High credit card balances

- Accounts in collections

- Charge-offs or defaults

- Too many credit applications

Bad credit is usually the result of patterns, not a single mistake.

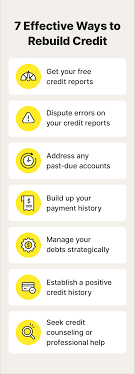

Step One: Know Where You Stand

You cannot fix what you do not understand.

Check Your Credit Reports

Review your credit reports from all major bureaus to identify:

- Incorrect information

- Late payment history

- Outstanding balances

Errors are more common than many people realize.

Step Two: Dispute Errors and Inaccuracies

Fixing credit alone often starts with correcting mistakes.

What You Can Dispute

- Accounts that are not yours

- Incorrect balances or dates

- Duplicate listings

Disputing legitimate errors can improve your score without spending money.

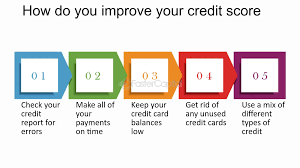

Step Three: Make Payments On Time—Every Time

Payment history is one of the most important credit factors.

Why Consistency Matters

Even one late payment can undo months of progress.

Practical Tips

- Set up automatic payments

- Use reminders or budgeting apps

- Pay at least the minimum due

On-time payments build trust with lenders over time.

Step Four: Reduce Credit Card Balances

High balances hurt your credit score, even if you pay on time.

Credit Utilization Explained

Using too much of your available credit signals risk.

How to Improve It

- Pay down balances gradually

- Avoid maxing out cards

- Consider paying more than once per month

Lower utilization often leads to faster improvements.

Step Five: Avoid Quick-Fix Promises

Many people turn to expensive services out of frustration.

Common Myths

- “Instant credit repair”

- “Guaranteed score increases”

- “Legal loopholes”

There are no shortcuts. Credit improvement follows predictable rules.

Step Six: Build Positive Credit History

Fixing credit is not just about removing negatives—it is also about adding positives.

Ways to Build Credit

- Use existing accounts responsibly

- Consider a secured credit card

- Keep older accounts open if possible

Time and consistency are key.

Step Seven: Be Careful With New Credit Applications

Applying for too much credit too quickly can backfire.

Why Fewer Applications Help

Each hard inquiry can slightly reduce your score.

Strategic Approach

Apply only when necessary and spaced over time.

How Long Does It Take to Fix Bad Credit Alone?

Credit repair is a gradual process.

Realistic Timeframes

- Small improvements: a few months

- Major recovery: one to three years

Negative marks lose impact as positive behavior continues.

When Fixing Credit Alone May Not Be Enough

Self-repair works for many people, but not everyone.

Situations That May Require Help

- Overwhelming debt

- Multiple accounts in collections

- Legal issues such as judgments

In these cases, professional guidance can complement personal effort.

Emotional Discipline Matters

Fixing credit is as much psychological as financial.

Stay Patient

Progress may feel slow at times.

Avoid Discouragement

Credit scores fluctuate. Focus on long-term trends, not daily changes.

Benefits of Fixing Credit on Your Own

- No service fees

- Full control of decisions

- Strong financial awareness

- Lasting habits

Self-repair often leads to better long-term outcomes.

Common Mistakes to Avoid

- Closing old accounts unnecessarily

- Ignoring bills during financial stress

- Relying on unverified advice

Simple mistakes can delay recovery.

Final Thoughts

So, can you fix your bad credit alone? In most cases, yes. The process requires honesty, consistency, and patience—but not expensive services or secret strategies.

Improving credit is less about perfection and more about persistence. Small, responsible actions repeated over time can gradually rebuild trust and financial confidence.

Bad credit does not define your future. With commitment and discipline, you can take control of your credit—and your financial direction—one step at a time.

Word Count:

491

Summary:

Certainly, you can repair your credit alone! It is easier to do it with expert help, but it can be done by yourself. Here are 3 tasks to do it.

Keywords:

Credit, credit repair

Article Body:

Certainly, you can! But let me ask you this: why fix it alone when you can have help?

While I�m not saying that it�s better to fix bad credit with the help of an expert, there are some indisputable advantages when you hire a professional credit repair company to take over your credit problems. If you don�t have the time for it, naturally it�s better to turn over everything to a professional credit repair company. If you don�t think you have enough experience dealing with the finance people � haggling, negotiating, disputing and so on � then once again, maybe it�s time to call for 911. There are just so many things you have to do when you�re fixing bad credit that really, when you compare what you�d have to go through with the amount the credit repair company is going to charge you, it seems like you�re paying a small price indeed.

But if you�re determined to try it out alone first then certainly, I won�t stop you and indeed congratulate you for having the fortitude for such a task.

Task #1 � Getting A Copy Of Your Credit Report

Listen well and remember: you need a copy of your credit report. Don�t rely on secondhand information. Don�t overestimate your knowledge of your credit history by telling yourself that you know everything that�s contained in your credit report. Really, you don�t. So be a good little boy (or girl) and follow Mama�s orders. Approach any of the three major credit bureaus � TransUnion, Equifax, Experian, take your pick � and ask for a copy of your credit report. If you�re feeling particularly diligent, why not ask a copy of your credit report from all three credit bureaus?

Task #2 � Understanding The Contents of Your Credit Report

Here�s our rule: if you want to prove the naysayers wrong by showing them that indeed you can fix your bad credit all by your lonesome, you should be very thorough when reviewing the items listed in your credit report. Absolutely no exception. Start from the very beginning and read on till the very last period. Mistakes can even happen with the personal information bit. If you�re Mary Roberts from Philadelphia, then why the heck are you listed as Mary Roberts from Louisiana? There�s an estimated thirty percent chance that your credit report could contain errors so there, that should keep you going.

Task #3 � Dispute!

Argue, beg, be persistent and never give up. Do what it has to take to make sure that those erroneous items are removed from your record on time. And be cunning. File for disputes a week before Christmas and Thanksgiving and since it�s a busy time of the year, the may just be obliged to temporarily erase those items from your records for lack of sufficient evidence.

More informations are available at http://www.debt-credit-00.info

Leave a Reply